Financial Empowerment for 51 Million Non-Traditional Earners

Key insights for independent workers to navigate financial challenges of careers outside of the traditional workforce

Growing Bolder Insiders receive access to more BOLD stories, weekly newsletters, daily inspiration and resources to make the rest of your life the best of your life!

Trouble signing in? Get Help!

Login with your existing Growing Bolder Insider Username and Password

Trouble signing in? Get Help!

Growing Bolder Insiders receive access to more BOLD stories, weekly newsletters, daily inspiration and resources to make the rest of your life the best of your life!

Become a GB Insider with your email address below.

Key insights for independent workers to navigate financial challenges of careers outside of the traditional workforce

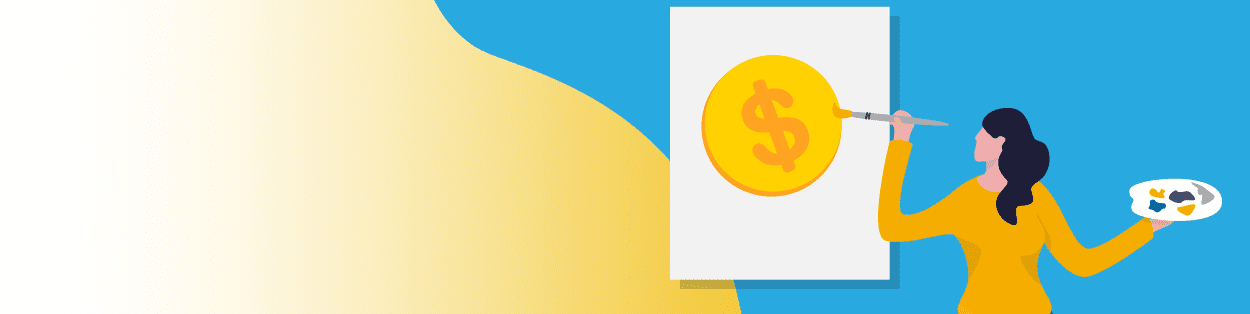

James Moskito is an ambassador for creatures of the sea. While he is on a mission to protect their environment, James has an annuity that protects his financial future in uncertain waters.

The Rolling Stones are rocking and rolling across the country as part of their 2021 No Filter tour, proving that life is not about age, it’s about attitude.

Millions of Americans have been impacted by COVID-19 and its economic consequences. Many workers have been forced to put a hold on new contributions to 401(k) or other retirement savings plans, which has resulted in a big opportunity cost in terms of lost future retirement income. Some pre-retirees have even delayed retirement altogether or had to reimagine their plans to consider part-time work to improve their savings. So, if your retirement savings progress has been sidetracked, don’t panic. It is never too late to re-start saving for money you will need in retirement.

The unusual circumstances of the pandemic have created a tough environment that has driven many Americans into an early retirement.

Renee Lamoreaux spent most of her work life in fire, smoke and ash. As a smokejumper for the U.S. Forest Service, she parachuted into fire zones to battle blazes all around the country.

The U.S. is facing the greatest retirement surge in its history. The population of older Americans is growing rapidly and living longer. America is quickly approaching a moment in time where there will be more people reaching traditional retirement age—age 65—than ever before.

With all of the surprises and uncertainty in our world today, there aren’t many things in your financial life you can always count on. However, there is one that can—annuities.

Two time International Hot Rod Association world champion Elaine Larsen joined the Growing Bolder team to talk about the thrills of being a jet car racer and also what she did to take the financial fear out of retirement.

Older Gen Xers and younger Boomers in particular have been forced to reconsider or restructure their retirement plans in the pandemic’s wake to account for unexpected obstacles.

Larsen has made a career out of going as fast as possible for five seconds down a straight and narrow quarter-mile track. So, to say she lives life at full-throttle is an understatement if there ever was one.

Your RISE Score, also known as Retirement Income Security Evaluation Score, can tell you whether you’re on track with your retirement income, and how well it will cover basic living expenses.