This post is sponsored by the Alliance for Lifetime Income, an official financial partner of Growing Bolder.

This post is sponsored by the Alliance for Lifetime Income, an official financial partner of Growing Bolder.

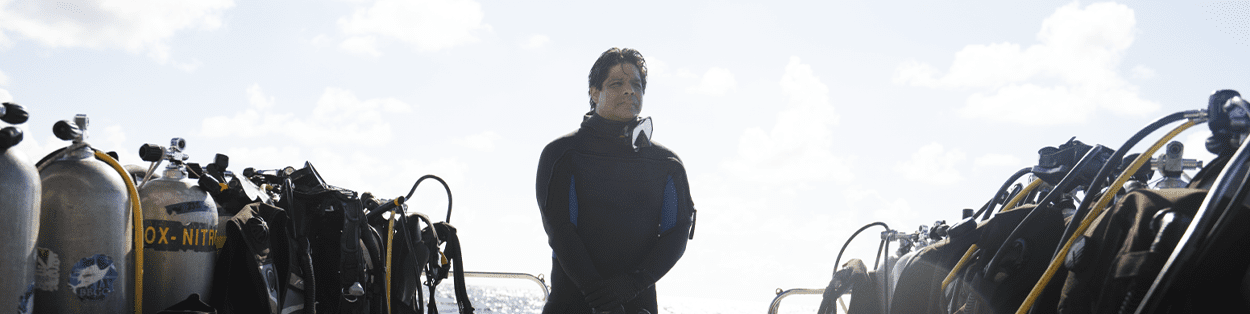

The U.S. is facing the greatest retirement surge in its history. The population of older Americans is growing rapidly and living longer. America is quickly approaching a moment in time where there will be more people reaching traditional retirement age—age 65—than ever before.

This historic demographic milestone, coined Peak 65™, will take place in 2024, but its effects have been accelerated by the huge increase in Americans retiring prematurely, by choice or due to layoffs during the pandemic.

Jason Fichtner, a senior fellow and head of the Retirement Income Institute at the Alliance for Lifetime Income, and Chief Economist at the Bipartisan Policy Center, says that the traditional three-legged stool which has provided retirement income security for generations—pensions, Social Security and personal savings—may not provide sufficient, reliable and protected retirement income today and for future generations.

Why? Pensions – one of the three sources of guaranteed income – have basically disappeared, and the other, Social Security, only covers about 40% of the average person’s pre-retirement income, leaving a large gap in income for millions of Americans. This impending issue requires the attention and collective action of multiple retirement security stakeholders—especially policymakers, financial professionals, and employers. All must work together to ensure that Americans planning for retirement have the information and means they need to help maintain their standard of living once that regular paycheck stops coming.

Fichtner believes that a new framework is needed that focuses on how protected income, like annuities, can better prepare individuals financially and help them maintain their planned and preferred standard of living.

Among the many possible solutions, here are some ways Fichtner suggests you can play a more active role in addressing your retirement income needs.

- Speak with a trusted financial professional about the protected retirement income you’ll need to help enhance your retirement income security—like an annuity—and how it fits into your current financial plan. They can help you discover and implement solutions that will help you meet, and possibly surpass, your financial goals.

- Learn about recent, important public policy changes that are being proposed and/or passed by the White House and Congress and are intended to increase retirement security for Americans. For example, during President Biden’s campaign, he proposed expanding payroll taxes for those with income above $400,000 per year to help strengthen the current Social Security program. If the plan is implemented, it would generate more than $700 billion in revenue over a decade.

- Talk with your employer or HR representative about the availability of protected lifetime income solutions as part of your workplace retirement plan. Thanks to the recent passage of the SECURE Act, adding annuities to your employer-sponsored retirement account is now a possibility and can help you feel more confident about having enough income to retire.