This post is sponsored by the Alliance for Lifetime Income.

This post is sponsored by the Alliance for Lifetime Income.

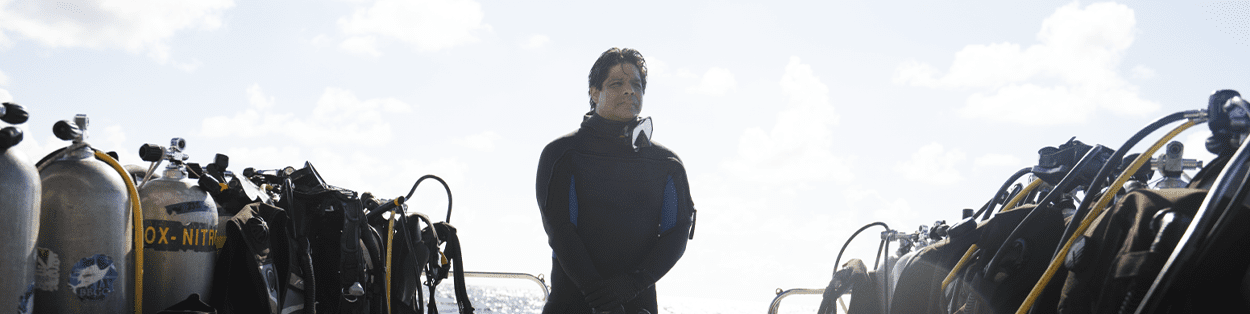

One in three new retirees struggle with finding purpose after leaving their job, according to a recent Edward Jones study. Without a plan for life after retirement, you may find yourself feeling restless, craving something more but not knowing where to start or what that something might be.

Here are tips for how to recognize and unlock your unique purpose in life after 50.

- Find your why. Identifying your main reason for getting up each and every morning is an important first step in creating a life that you enjoy living. Having a purpose – or a why – can help with longevity, health and provide a sense of fulfillment.

- Try The Napkin Test. The napkin test is a quick and simple self-awareness exercise to help you map out what you are looking for, or should be looking for, in your next chapter. To start, you make a list of your gifts, passions and values. Once you have the three columns, you see how they connect and can align to your calling. “If you approach every day with an intention to use your gifts on things you feel passionate or purposeful about in an environment that aligns with your core values, you’ve got a calling,” Leider says.

- Cultivate a sounding board. Identify a group of trusted friends and family you can turn to for advice and perspective. “You need at least one person you see all the time, someone who’s a great listener and who allows you to make your decision,” Leider says. These trusted confidantes can provide counsel and help you define your purpose.

- Set yourself up for success. Once you’ve discovered your passion and determined what you want to spend your retirement doing, you will want to ensure you have enough income to achieve your goals. Annuities are a great financial option for individuals looking to cover basic living expenses with protected income. They can also help secure a path toward a comfortable retirement – no matter your career, the size of your paycheck or the volatility of the stock market. Research shows retirees with annuities are happier than those without. It’s always a good idea to team up with a financial professional who understands your situation (and your purpose) and can work closely with you to help you achieve your financial goals.

As Leider says, “our time is the most precious investment for our life. We need to stop and reflect on our lives and what matters to us most.” Don’t let another minute go to waste. Identify what brings your life purpose and go after it.

To learn more about finding purpose in your retirement, visit protectedincome.org.