Last Updated on October 22, 2023

This post is sponsored by The Alliance for Lifetime Income.

This post is sponsored by The Alliance for Lifetime Income.

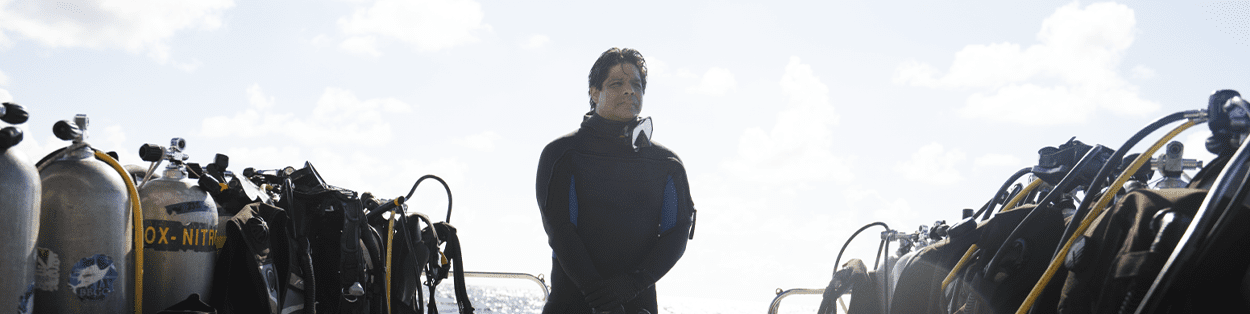

Rosaly Lopes can recall the exact moment when she decided to become a volcanologist. “During my college days, I was taking this class – Geology of the Earth and the Planets – and the professor did not show up,” she explains. Eventually, someone announced to the class that Mount Etna had erupted and the professor was en route to Sicily to study it.

“The volcano erupts and the professor has to go? That’s what I want to do,” she recalls, smiling from ear to ear. From that moment forward, Lopes knew which career path she would follow— even if it was covered with 2,000-degree Fahrenheit lava.

Since then, she’s been to active volcanoes on all seven continents, including Mount Erebus in Antarctica. “Every volcano is a little different,” she explains. “So, you’ve really got to know something about that volcano and know its behavior and its pattern, and then figure out how you’re going to go there.”

As with any profession, it helps if you love what you do. But in the field of volcanology, you have to love the risk, too. Dodging lava bombs, avoiding deadly levels of noxious gases and side-stepping lava while conducting field studies are just part of the job.

Despite her appetite for risk in her career, Lopes doesn’t feel the same way when it comes to her money. In fact, she has the opposite view when it comes to her retirement plan.

“I take a lot of risk when I go to volcanoes, but in my personal life, not so much,” she says. “I tend to be more conservative, particularly with my finances.”

Lopes decided to purchase two annuities because they offer her the protection and flexibility she was looking for in retirement. “I want to have the option to help my son and grandkids. I want to have the option to stay home and write books too, if I want to. It’s all about options in retirement.”

And she counted on that protection especially during the pandemic. “With the stock market going up and down, having part of my retirement [savings] in annuities really helps me to feel that I can ride this out feeling secure,” she says.

She likens her annuity to a way out of a dangerous situation on the job. “You know some things are pretty risky, but you calculate those risks and still do it. But you want your basic safety guaranteed. You want to have, let’s say, your escape route if you’re on the volcano.”

Managing risk is nothing new to Lopes. While conducting research on Mount Etna, a crater suddenly erupted, launching volcanic bombs into the air. “You don’t run,” she says. “You stay where you are, look up and if a bomb is coming toward you, you dodge it.”

Like all volcanologists, Lopes wants to know why volcanoes are formed, and studies their eruptive activity to hopefully one day be able to predict future eruptions. The impact volcanoes have on the Earth and how they affect humans and the environment is something she feels is worth sharing.

“I’m a very big supporter of education and outreach,” she says. “I do a lot of talks in schools. It’s really important to encourage young people to go into STEM (science, technology, engineering and math) subjects.”

When Lopes finally hangs up the seismometer, she wants confidence that her retirement income – especially the income she can count on – can support the lifestyle she envisions for herself.

“I think very much in terms of paycheck and ‘play check.’ You need the check to pay for the basics. Then hopefully you have plenty of money to play as well.”

To learn more about how to protect your retirement, visit protectedincome.org.