Growing Bolder is all about our belief system and daily choices. More is possible for all of us, no matter our age, because it is never too late to find a new passion, start a new relationship, improve your health and wellbeing, or start saving your money.

Cetin Duransoy is an expert in the financial services industry. With decades of experience as a senior executive with Capital One and Visa, he’s now the CEO of Raisin, an all-in-one savings tool designed to help you take control of your funds.

“It is never too late to start saving,” Duransoy urges. “You may not have built those habits back in the day, but it’s never too late. It’s all about consistency.”

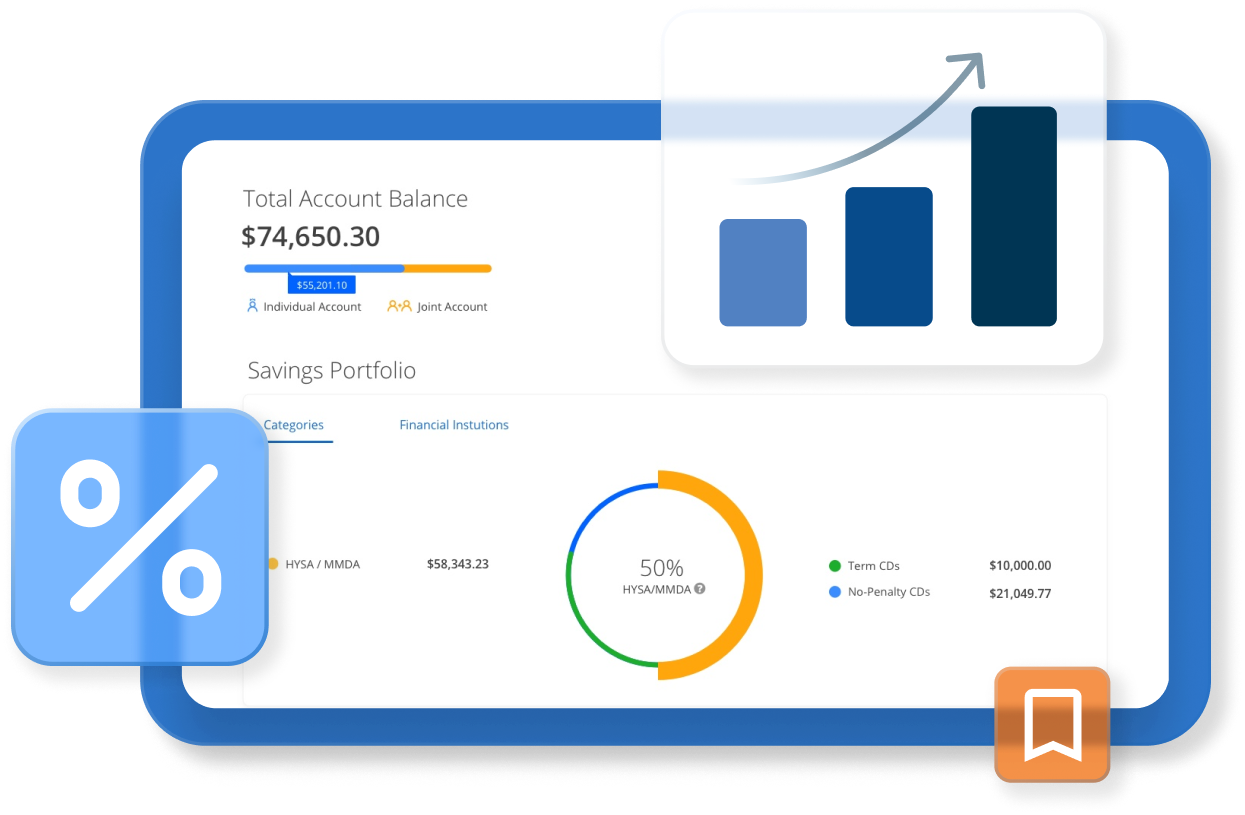

Raisin is a unique savings platform that connects users to 75 different banks and credit unions nationwide, all with a single, secure login. Their mission is to remove the barriers to investment products, so people can select from some of the nation’s best interest rates, all in one location.

No matter where you are on your savings journey, Duransoy says the best strategy is to develop routine habits, even if with just a small amount of your money, instead of trying to build your finances at inconsistent times with larger sums.

“I would think, ‘Of the $100 that I receive, I’m going to put even just $2 to the side for savings.’ That’s all it takes,” Duransoy told Growing Bolder. “Once that becomes a habit, then building your savings becomes so much easier.”

When building your financial portfolio, Duransoy advises building a healthy portion of principal-protected assets as a safeguard against financial hardships as you age.

“When you think about the risk spectrum, on the riskiest end you have cryptocurrency, and then options, individual stocks, and then ETFs,” Duransoy said. “What is common in all of these products is that your principal is not protected. You can lose the principal.

“On the other end of the spectrum, the safer side, you find what we call the fixed income securities, such as CDs, savings and money market accounts. Your principal is protected at that moment. Your principal is never going to come down,” Duransoy continued.

These principal-protected assets are all available on the Raisin platform, designed specifically for older adults to easily navigate and move their money across various banks and credit unions to secure higher interest rates and safely grow their money.

“The shorter the time horizon that you might need to access your money, it should stay in a principal-protected area, especially in retirement age, or even for savings like college, “Duranosy says. “One of my kids is at college, and one is about to go to college, so I want that money to be in a principal-protected account.”

Get started at Raisin.com/GrowingBolder – and earn $50 in bonus cash by using the code BOLDER when you make a qualifying deposit. Terms and conditions apply.

This article was created in collaboration with our friends at Raisin, a paid partner of Growing Bolder.