Last Updated on July 13, 2021

This post is sponsored by the Alliance for Lifetime Income.

This post is sponsored by the Alliance for Lifetime Income.

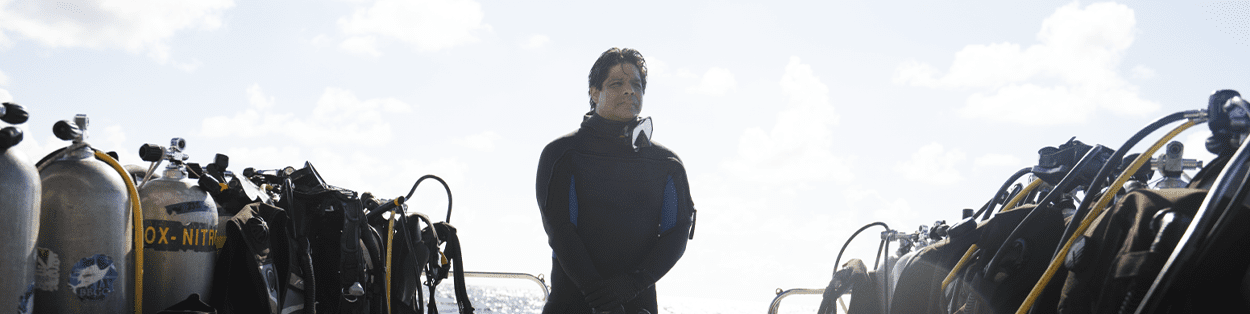

As one of the most sought-after production directors in the music industry, Dale “Opie” Skjerseth is a rock star in his own right. In 2020, he was the production director for the Rolling Stones’ No Filter tour- and like so many others in the industry, he went virtual after the coronavirus shut down concerts everywhere. But he’s seen a lot of venues and after decades of witnessing how easily things can go wrong at a rock concert, he’s learned to prepare for the worst. Night after night, every unique venue presents new challenges. He’s been in the business since 1979 — back when harnesses weren’t standard equipment for workers climbing up to the ceiling to rig lights.

“Myself, I’ve only fallen once. It was about 13 or 14-feet, and I bounced off of what I hit,” recalls Opie. “So, at that young age, I probably bruised myself more than I broke anything. And then if I broke anything, I didn’t care. I wanted to make my career. I’d say, ‘Okay, wrap me up. Put duct tape around me. I’ll be fine.’”

Plenty of other situations call for something stronger than duct tape: “There’s the risk of storms rolling in and lightning hitting towers and people being electrocuted,” Opie cautions. “I’ve had people being unprepared for something and fall out of a cart and break a leg.”

The risks that Opie and his crew face aren’t always physical. They’re financial, too. “Our biggest risk is when the tour shuts down,” he says. “Honestly, that’s where it’s a big financial hit to people.” The Covid pandemic was the great equalizer for bands of all size and stature when it hit last year. As unlikely as that scenario was, it was a reminder to leave nothing to chance.

Today, he not only acknowledges risk but plans for it, as he explains in this behind-the-scenes video. If you know there’s a chance you might fall and hurt yourself at work, you need to create a financial cushion to catch yourself, not just for your immediate needs but for your retirement plan too.

“No one’s going to do it for us, especially in the entertainment world,” he says. “We had a lot of cash flowing around in the early days, so it was nice. But you have to put it away somewhere. It can’t sit in a safety deposit box all your life.”

This is the advice an 18-year-old Opie was given by his dad back when he had dreams of going on tour and he took it to heart. Today, he passes his dad’s words of wisdom along to the crew he travels with. He’ll share it with anyone who wants to listen because he knows how important it is to create your own financial plan for retirement in a freelance career that doesn’t offer a pension or 401(k).

“A lot of them have called me later and thanked me,” he says. “I have a couple of guys that are really good friends that have since invested in annuities and other funds.”

As any hardworking crew member knows, success comes from teamwork. That’s why Opie not only shares his advice — he solicits it from others, too. He has worked with financial professionals over the years and has found experts that match his investment style.

“As my dad said to me, if you leave the financial advisor’s office confused, he is not the guy for you,” Opie says.

With the help of trusted professionals, Opie has secured a financial future for his family. He has three annuities — one fixed rate annuity and two variable annuities— plus other accounts, which are connected to a trust.

“People should pay attention to their finances,” Opie says. “Yeah, I took a summer dream and turned it into my job, but I also made sure to save so I could have something for the future.”

So how does he define protected income? “It gives you the freedom to do what you need to do.”

To read more about Opie Skjerseth click here.